Our Professional Services

in Oil, Gas & Low-Carbon Fuels

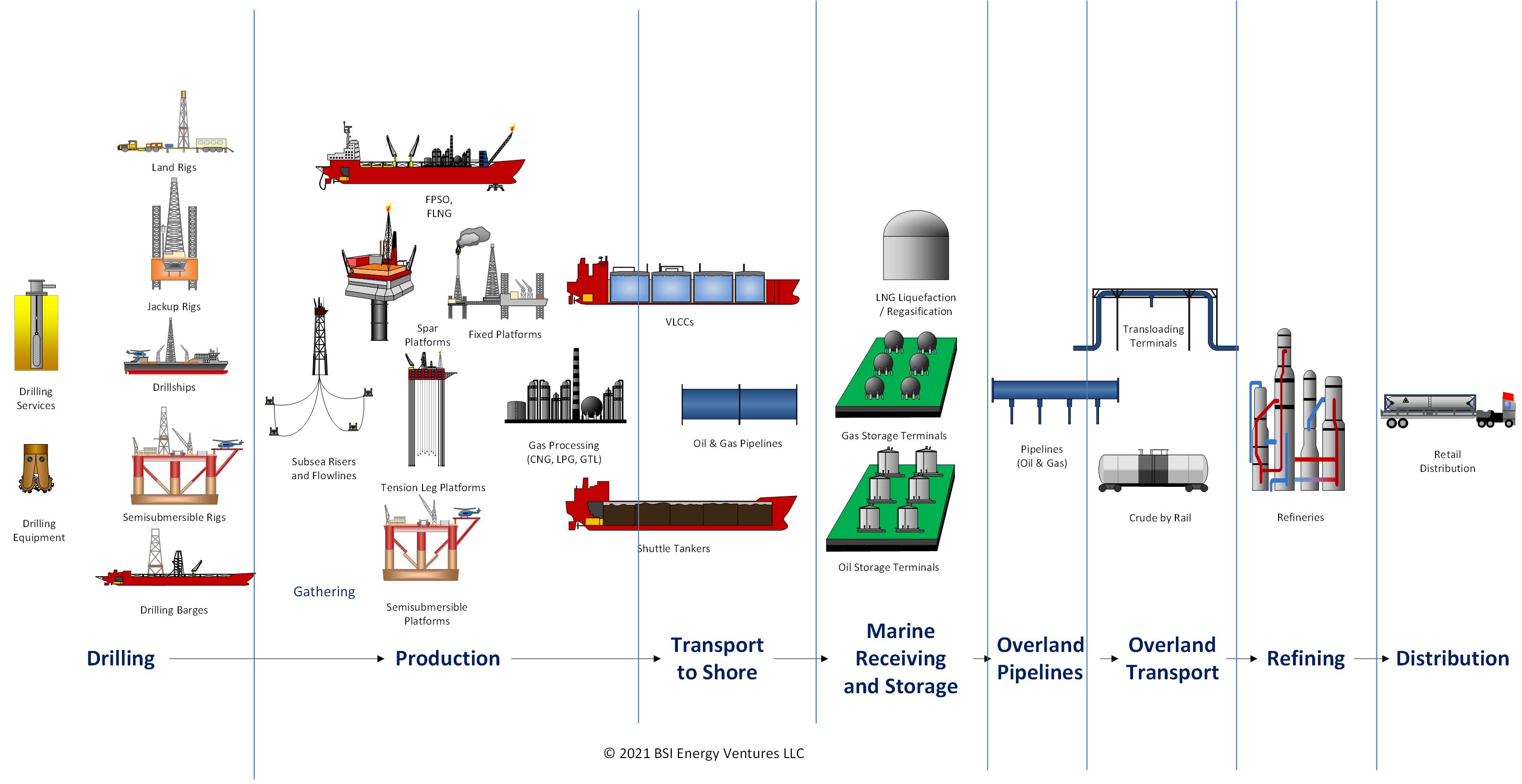

Scope of Boston Strategies’ Oil, Gas & Alternative Fuels Practice

VIABILITY ASSESSMENT

Due to long investment cycles, such as for refineries, decision-making must account for a high degree of uncertainty. Moreover, demand varies over time as demographics and economic conditions change, and equipment and service prices change over extended capital and construction timeframes. BSI deploys proven financial and risk management tools to support capital investment decision-making.

LIFECYCLE COST

Initial cost is rarely the most reliable indicator of lifecycle cost for capital-intensive and highly engineered equipment and systems such as steam turbines. Moreover, small improvements in reliability can be extremely valuable if they increase operating efficiency or reduce downtime. BSI combines advanced economic methodologies and engineering expertise to help you make the best long-term technology and vendor choices.

TECHNOLOGY SELECTION

New Technologies, such as RFID downhole, have little or no cost or benefit history, and can take a long time to gain acceptance because of an industry predisposition toward proven solutions. BSI’s highly-qualified economists address complex issues involving sophisticated costing and indirect benefit assessment methods to support decisions with broad impact, such as technology selection.

SHOULD-COST

The prohibitive cost of downtime, for example on rigs, makes reliability imperative: the opportunity cost of a rig often exceeds the cost of the equipment. BSI uses its seven-step methodology to derive how much products, services, and solutions should cost.

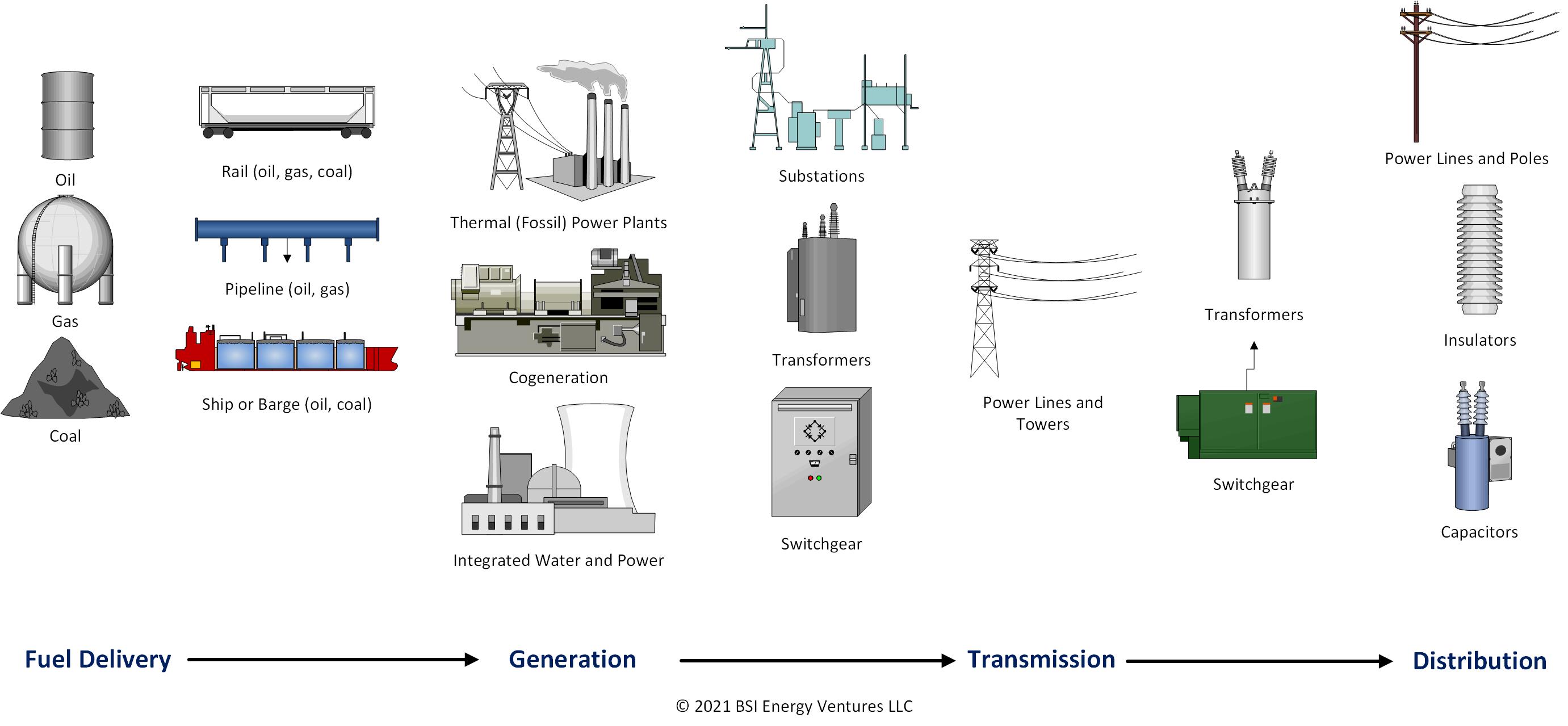

Scope of Boston Strategies’ Power Practice

GAIN-SHARING AGREEMENTS

Bundled pricing of solutions that involve both products and services are often priced on a per-unit-of-output basis rather than a simple upfront cost. This can align both parties on the benefits, but should the benefits then be split between the buyer and the seller, and if so, how? BSI has 20 years of experience in structuring gain-sharing agreements.

FRAMEWORK AGREEMENTS

Partnerships, for example technology alliances in produced water treatment, should yield far more than cost reduction and should result in enhanced innovation and a more agile response to changing market and regulatory conditions. Long-term partnerships should combine the best of both parties’ strengths and achieve dramatic results. BSI brings to bear its proprietary optimization models to determine the optimal number of suppliers and contract term, and its industry experience to help negotiate fruitful long-term partnerships.

PARTNERSHIP AGREEMENTS

The interrelationship between components, such as in a smart grid, requires a systems view, but it can be difficult to compare system bids if they are different on many dimensions. BSI uses its proprietary market intelligence and cost and price benchmarks to credibly evaluate bundled bids.

Our work frequently addresses highly engineered materials and services such as:

- API Pumps

- Blow-Out Preventers

- Catalysts

- Chemicals

- Compressors

- Detection Systems

- Downhole Tools

- Drill Bits

- Drilling Services

- Drilling Fluids

- Flow Meters

- Gas Turbines

- Heat Transfer Equipment

- Membranes and Membrane Systems

- Oil & Gas Production Chemicals

- Oil Country Tubular Goods (OCTG)

- Pipeline Drone

- Pressure Vessels

- Seals

- Spill Control Systems

- Steam Turbines

- Surface Equipment

- Switchgear

- Transformers

- Turbines

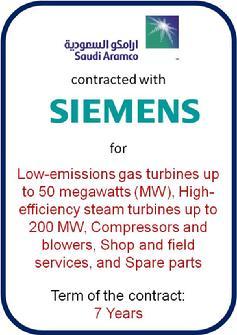

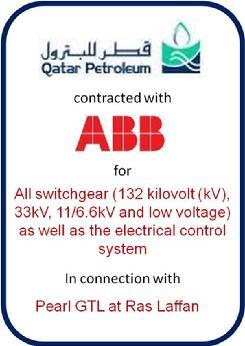

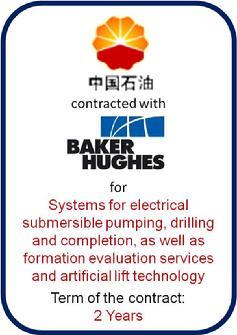

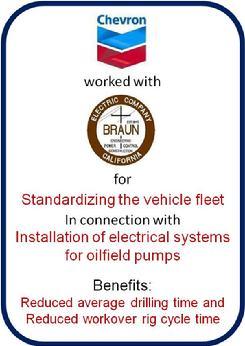

Below are some examples of publicly-disclosed relationships that are representative of the successes that we have previously helped to facilitate (although it should be clear that we do not claim direct credit for all of the examples below).