Strategic and Competitive Planning

Corporate Market Analyses

Market Size Studies

Segmentation and Positioning Studies

Regional & Global Market Growth & Forecast Studies

Competitive Intelligence Studies

Strategic Options Evaluations

Examples:

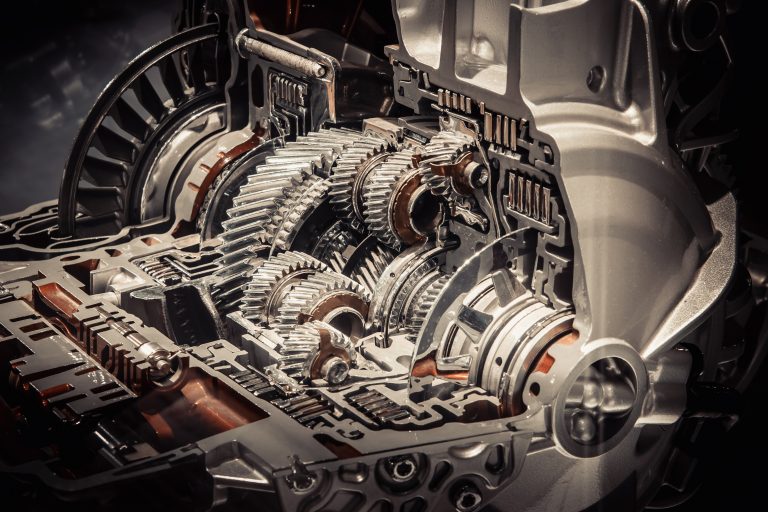

Multinational Gear Manufacturer.

For an automotive OEM, Jacoby’s staff quantified the market size of 12 technical end-user and wholesale markets for automotive and industrial gears. The team provided market sizes, profit margins, demand forecasts, competitive analysis, gap analysis, and strategy recommendations. The team was headed by an industrial gear expert, and included economists and strategy consultants. The project was executed in North America and Europe, both remotely and onsite.

Contract Manufacturer.

For a contract fabricator and manufacturer, Jacoby’s team developed country-specific market sizes for 10 industrial markets, and delivered a competitive assessment of each market in each country, including market shares, competitive strengths and weaknesses of the existing players, potential entrants, and a Strengths-Weaknesses-Opportunities-Threats (SWOT) analysis of the client’s positioning. By applying criteria, weightings, decision analysis tools, and financial analysis of the capital and operating costs in each market and segment, we helped the client set a firm strategy for growth.

EPC Firm.

For an Engineering, Procurement & Construction (EPC) firm, Jacoby and his team developed a market segmentation and positioning analysis that allowed the client to define a pathway to entering a new market with its existing services. In addition to defining markets, the consulting team held focus groups with potential partners to ascertain their interest and fit with the client’s services.

Economic & Fiscal Impact Studies

Carbon Tax Impact Studies

Greenhouse Gas (GHG) Emissions Policy Studies

Industrial Air Pollution Standards

Low-Carbon Fuel Standards

Emissions Trading Schemes (ETS)

Power Generation Efficiency

Renewable Energy Tax Credit Analysis

Analysis of Tradeable Energy Certificates

Examples:

US Agency for International Development.

For USAID, Jacoby’s staff quantified Tunisia’s comparative advantage of agricultural production for hard and soft wheat, dates, potatoes, barley, oranges and olive oil. BSI analyzed the “domestic resource cost” of seven agricultural commodities in (potatoes, oranges, olives, dates, hard wheat, soft wheat, and barley) in order to assess the success of privatization programs and advise on the development an import substitution policy and supporting institutional, regulatory and legislative frameworks.

City of New York.

- The New York City Housing Authority (NYCHA) engaged Jacoby’s expertise to quantify and model end-to-end supply chain costs and operations, and model alternative scenarios, in order to determine the most efficient and effective degree of centralized warehousing.

- He compiled a baseline supply chain cost; developed a baseline of the flows, unit costs, and service levels; evaluated the costs of several decentralized scenarios; audited the current operation and identify any gaps in management practices that would affect the comparison; and documented the findings in a full-text report with supporting illustrations, diagrams, and tables.

- Based on the analysis, David Jacoby successfully aided the City in petitioning for an exception to the nationwide ruling on centralized warehousing and offered specific strategies and tactics to further reduce New York’s procurement and warehousing costs.

City of Detroit.

- For a railroad, quantified the economic impact of a major cross-border rail tunnel. Assessed the soundness of the business strategy and quantified the economic impact to be generated during the construction phase and ongoing operations.

The World Bank and Other International Lending Institutions.

In support of privatization initiatives, Jacoby has helped governments and lending institutions audit business plans, restate financial results, forecast financial performance under various scenarios, and screen potential buyers.

- For the OECD, supported projects to help small and medium-sized enterprises in the GCC and Jordan become more competitive. Also supported business integrity initiatives in the MENA region, notably concerning public-private partnerships in Morocco.

- For a Polish copper mine, he assisted in the restructuring of the holding company during its transition to private ownership and operation.

- For the government of New Zealand (on behalf of an investment bank), BSI staff assessed the business plan and quantified the market price of the national railway. We interviewed senior executives to determine the realism of management projections. Developed scenarios to sell, “run down,” or break up the railway, estimating sales revenue for the government’s Treasury.