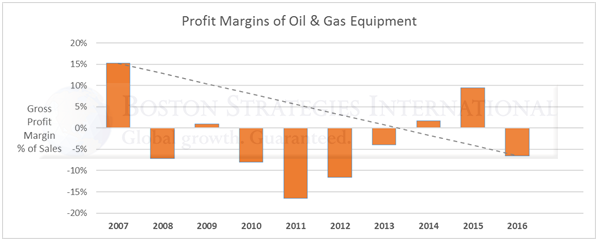

The oil and gas equipment supply industry has been hit hard in recent years. While nominal prices increased by 17% between 2007 and 2015, gross profit margins have fallen by 22%, from +15% in 2007 to -7% this year. Margins grew in 2015 for the first time in six years, but are falling again this year, driven by continued low oil prices. Suppliers are accepting price reductions in order to hold onto contracts and maintain their market share, in hopes of better times ahead.

Over the last two years, compressors and instrumentation suppliers have fared the worst, with profits declining 40% on average. Manufacturers of pumps suffered profit declines of 10%. The profitability of manufacturers of specialty forgings and fittings for oil & gas applications has been volatile, with profit margins swinging between -20% and +23%.

Suppliers to the oil and gas industry can’t just sit back and think “I’ll lowball my price this year and I’ll take a loss, planning on staying in business, because next year things will get better.” That’s probably not a brilliant strategy, because if things persist to be bad over the next three or four years, you won’t be able to sustain it. BSI’s supply chain forecast shows continued rough weather for equipment suppliers until 2019, and 2022 before strong growth resumes.

Today there is a window of opportunity for leading companies – and I don’t mean the big companies – I mean companies that lead, the companies that pro-act, the companies that change the paradigm, that put the energy and the marketing investment in to develop breakthrough technology-service-information solutions and strategic mergers, acquisitions, or partnerships that can dramatically reduce cost. These companies will add more value on among the bid slate, will win and become embedded in the future of the next generation supply chains. And that’s really the big opportunity for everybody today and it’s the way that the whole market will adjust and recalibrate.

Please contact us for more information and services.